Franchise or not?

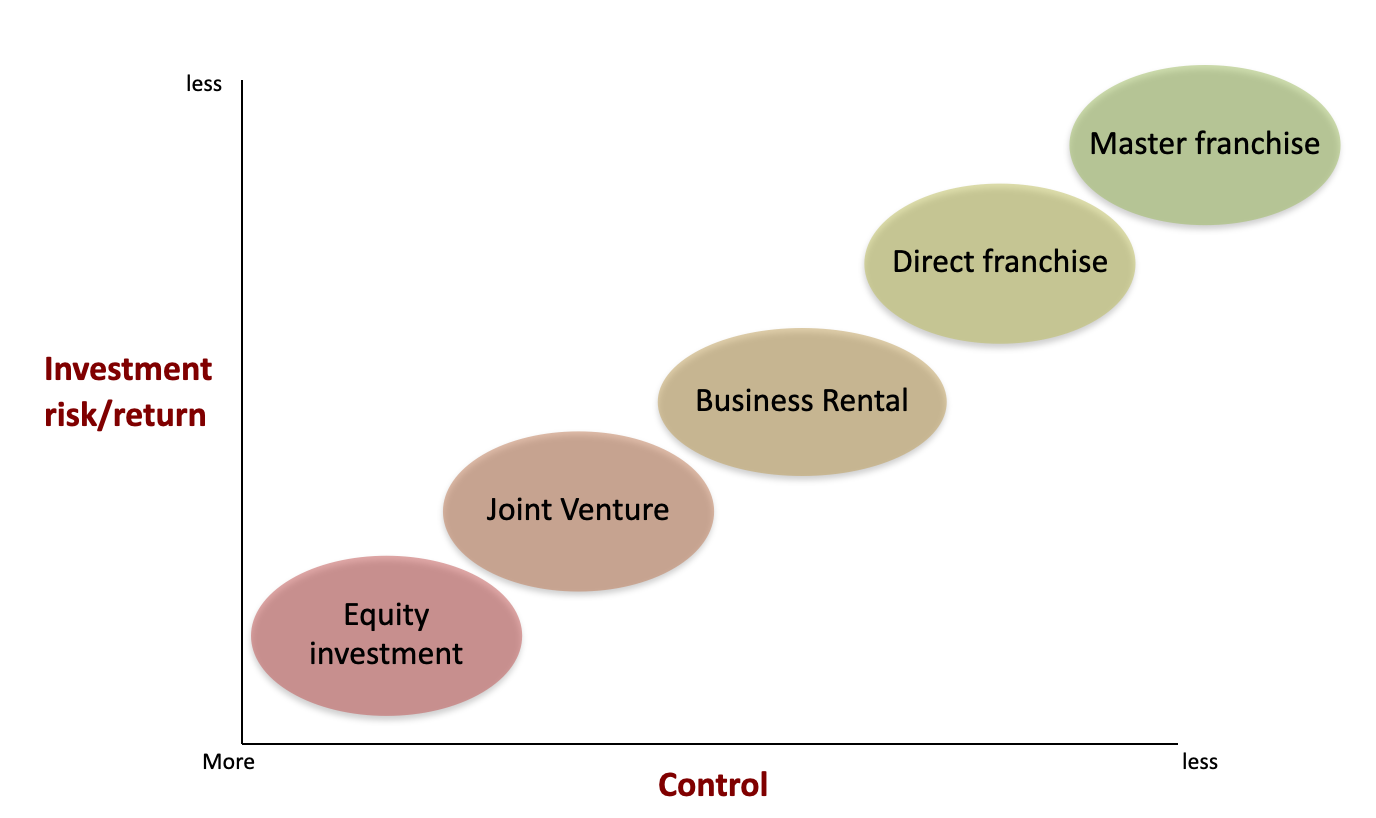

Developing a sound franchise strategy is the most important step that determines brand success in a country.

It is critical to choose the appropriate growth vehicle.

Equity Investment

In the case of a Equity Investment, the Equity Owner has total control over the business and there is no income sharing. Brand integrity is more easily achieved. However, this business model requires a more structured organisation as well as higher capital investment which translates into elevated financial risk.

Joint Venture

A Joint Venture is based on a group of business partners with local knowledge who share the capital investment. The business model tend to focus mostly on P&L management and can develop potential relationship issues due to the closeness of the business parties.

Business rental

In the case of a Business Rental, the Franchisor buys or leases the real estate (for example it builds the store and then subleases it to the franchisee). The revenue for the Franchisor is represented by royalties and rental income – which is directly correlated to the level of sales. In this business model, the franchisor can enjoy a greater control and leverage on franchisees and a higher return per store.

Direct Franchise

No investment is required from the Franchisor in the case of a Direct Franchise and consequently there is limited financial risk. The return on the investment is, however, capped (e.g. royalties) and the Franchisor has to rely on the franchisee capability to guarantee the brand integrity. The relationship between Franchisee and Franchisor has a key role in the success of this business model.

Master Franchise

This business model can be the potential vehicle for aggressive growth with just limited investment in time and resources from the Franchisor. However, and even more than in the case of the Direct Franchise, the Franchisor has limited brand control and relationship is crucial too success.

All rights reserved.